The report provides a fundamental overview of the trade together with definitions and classifications. Touchdown in the capital market brings new alternatives for Zhao Lixin. According to the prospectus, Galaxycore plans to raise 6.96 billion yuan in this preliminary public providing, of which 6.376 billion yuan shall be used for 12-inch CIS integrated circuit attribute process analysis and growth and industrialization tasks, and 584 million yuan will be used for CMOS image sensor analysis and growth. venture. “After going public, we’ll transform to the Fab-Lite mannequin.” Zhao Lixin mentioned that in the future, the company will broaden its personal production capability by building part of its production strains, and enhance the corporate’s excessive-end products. Research and development capabilities and velocity of analysis and improvement.

The report provides a fundamental overview of the trade together with definitions and classifications. Touchdown in the capital market brings new alternatives for Zhao Lixin. According to the prospectus, Galaxycore plans to raise 6.96 billion yuan in this preliminary public providing, of which 6.376 billion yuan shall be used for 12-inch CIS integrated circuit attribute process analysis and growth and industrialization tasks, and 584 million yuan will be used for CMOS image sensor analysis and growth. venture. “After going public, we’ll transform to the Fab-Lite mannequin.” Zhao Lixin mentioned that in the future, the company will broaden its personal production capability by building part of its production strains, and enhance the corporate’s excessive-end products. Research and development capabilities and velocity of analysis and improvement.

Launched in September 1999, Autocar India is the country’s leading authority for motorbike and automobile house owners; always searching for to be a forerunner. The magazine is understood for pioneering street testing in India, and is the final phrase on new automobiles and bikes because of its authentic street check verdicts. It was also the first journal to discover the Tata Nano, and showcase its interiors. Other magazines are envious of its fame for exemplary editorial content, as well as excessive production standards with the journal receiving accolades from each the industry and consumers alike.

Porter’s five forces model within the report provides insights into the aggressive rivalry, supplier and purchaser positions available in the market and alternatives for the new entrants in the global automotive suspension market over the period of 2018 to 2026. Further, Progress Matrix gave within the report brings an insight into the funding areas that existing or new market players can consider.

ARK believes AMaaS at scale may be priced at $zero.25, however my view is barely extra conservative. I ended up with a blended value per mile of $zero.20. At this value, Tesla would nonetheless have an astonishing fifty two% gross margin and an AMaaS gross profit of $1.6T per yr, which helps clarify why I am so bullish on TSLA because of its AMaaS potential. This won’t be achieved by 2030 though, as a result of Tesla would need a fleet of 60% 269M = 161M AVs for this. Even when Tesla produces 20M autos per 12 months from 2030 onwards, and already has a fleet of 50M+ AVs at that point, it’d still take Tesla till a minimum of the second half of the 2030s to achieve this point. And this is assuming Tesla stops promoting cars right now, which it could actually clearly not afford but, so some time in the 2040s may be a extra sensible timeline.

Global Harness Business Analysis Report 2016 also focuses on development policies and plans for the business as well as a consideration of a price construction analysis. Capability production, market share analysis, import and export consumption and worth value production worth gross margins are mentioned.…

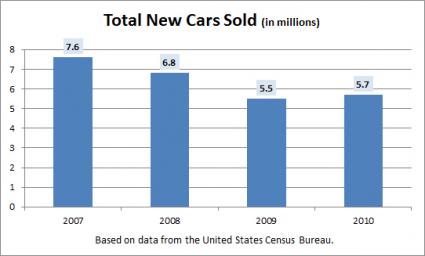

Most auto industry analysts knew it was coming, increased rates of interest for new vehicles, indeed most customers available in the market for a brand new automobile in all probability also thought-about it. The subprime fallout has hit the US Auto Industry and auto loan charges just went up. Are you frightened? Automotive AC Compressor Market by Configuration (Scroll Sort Compressor and Rotatory Type Compressor), Car Type (Passenger Vehicles, Gentle Business Autos and Heavy Commercial Automobiles), Product Sort (Mounted Displacement Sort, Steady Displacement Variable Type and Electrically Operated) and Gross sales Channel (Unique Tools Manufacturer and Aftermarket): International Opportunity Evaluation and Trade Forecast, 2021-2030.

Most auto industry analysts knew it was coming, increased rates of interest for new vehicles, indeed most customers available in the market for a brand new automobile in all probability also thought-about it. The subprime fallout has hit the US Auto Industry and auto loan charges just went up. Are you frightened? Automotive AC Compressor Market by Configuration (Scroll Sort Compressor and Rotatory Type Compressor), Car Type (Passenger Vehicles, Gentle Business Autos and Heavy Commercial Automobiles), Product Sort (Mounted Displacement Sort, Steady Displacement Variable Type and Electrically Operated) and Gross sales Channel (Unique Tools Manufacturer and Aftermarket): International Opportunity Evaluation and Trade Forecast, 2021-2030. Because the economy continues to trip on it’s current monetary rollercoaster one of the hardest hit industries has been the automotive business. After all, if each individual can customize the devices on their flat panel show dashboard, just as you customize your computer systems desktop, then how will others who borrow the automobile deal with it, and how will people who lease vehicles cope with the variations, and will they have to reconfigure the hire-a-automobile before they start so all the things is the place they’re used to it being situated? You see, the US Navy, FAA, and years of analysis had gone into all this for essentially the most efficient position of every instrument. Automotive designers additionally try to preserve it easy for less distraction.

Because the economy continues to trip on it’s current monetary rollercoaster one of the hardest hit industries has been the automotive business. After all, if each individual can customize the devices on their flat panel show dashboard, just as you customize your computer systems desktop, then how will others who borrow the automobile deal with it, and how will people who lease vehicles cope with the variations, and will they have to reconfigure the hire-a-automobile before they start so all the things is the place they’re used to it being situated? You see, the US Navy, FAA, and years of analysis had gone into all this for essentially the most efficient position of every instrument. Automotive designers additionally try to preserve it easy for less distraction. The windscreen supplies structural power to the physique of the car and helps hold passengers contained in the car when an accident happens. Straughn was arrested for alleged public intoxication, and it was discovered that he had allegedly failed to arrive for weekend detention in reference to a trespassing cost, based on authorities. Straughn died of ” power alcoholism with hypertensive and atherosclerotic cardiovascular disease contributing,” based on the health worker. He had been positioned in a special medical cell about 12 hours earlier than his demise, in accordance with authorities.

The windscreen supplies structural power to the physique of the car and helps hold passengers contained in the car when an accident happens. Straughn was arrested for alleged public intoxication, and it was discovered that he had allegedly failed to arrive for weekend detention in reference to a trespassing cost, based on authorities. Straughn died of ” power alcoholism with hypertensive and atherosclerotic cardiovascular disease contributing,” based on the health worker. He had been positioned in a special medical cell about 12 hours earlier than his demise, in accordance with authorities. When buying or evaluating a used or “pre-owned ” automobile be it car, SUV, van, truck or even a semi-tractor ring a “stroll-around” or preliminary inspection of the automobile is the primary point of order. Augmented product: a Ford (or any other brand for that matter) that’s in absolutely working condition, has an attractive design, handed all safety tests, has four-wheel steering, built-in alarm and air condition, and many others. The automotive can also be accompanied by other benefits provided by the motor firm like guarantee, instalments, and so forth.

When buying or evaluating a used or “pre-owned ” automobile be it car, SUV, van, truck or even a semi-tractor ring a “stroll-around” or preliminary inspection of the automobile is the primary point of order. Augmented product: a Ford (or any other brand for that matter) that’s in absolutely working condition, has an attractive design, handed all safety tests, has four-wheel steering, built-in alarm and air condition, and many others. The automotive can also be accompanied by other benefits provided by the motor firm like guarantee, instalments, and so forth.  At one time limit the venerable status Rolls-Royce wonderful motor cars had been made and manufactured in the united statesA. – the United States of America. Clearly the main point of the automotive brakes is to scale back the speed of the automobile and then deliver it to a halt. There are many completely different types of vehicles available and the brakes involved are totally different on nearly all of them. In an automobile, it is common for the system to be run hydraulically with liquid strain ensuing in the pistons transferring and making certain that brakes are utilized to the wheels.

At one time limit the venerable status Rolls-Royce wonderful motor cars had been made and manufactured in the united statesA. – the United States of America. Clearly the main point of the automotive brakes is to scale back the speed of the automobile and then deliver it to a halt. There are many completely different types of vehicles available and the brakes involved are totally different on nearly all of them. In an automobile, it is common for the system to be run hydraulically with liquid strain ensuing in the pistons transferring and making certain that brakes are utilized to the wheels. Professors Peter Newman and Jeff Kenworthy have give you an fascinating concept that they name ‘Car dependency’ to clarify the state of affairs in the major cities of the world, principally of the key cities in the United States, Canada, Australia, New Zealand and Europe. The upcoming New York Worldwide Auto Show (NYIAS), dubbed as the most important occasion of its sort, will likely be hosting idea vehicles from United States’ second largest car producer, Ford. This 12 months, the Ford Motor Company will likely be showcasing three concept automobiles – two from Ford and one from Lincoln. All of these three concept vehicles are exhibiting the path that Ford Motor Company is prepared to take in the near future.

Professors Peter Newman and Jeff Kenworthy have give you an fascinating concept that they name ‘Car dependency’ to clarify the state of affairs in the major cities of the world, principally of the key cities in the United States, Canada, Australia, New Zealand and Europe. The upcoming New York Worldwide Auto Show (NYIAS), dubbed as the most important occasion of its sort, will likely be hosting idea vehicles from United States’ second largest car producer, Ford. This 12 months, the Ford Motor Company will likely be showcasing three concept automobiles – two from Ford and one from Lincoln. All of these three concept vehicles are exhibiting the path that Ford Motor Company is prepared to take in the near future. With auto sales plummeting, incentives are the required device to drive consumers into showrooms. Regardless of whether the vehicle is owned by a federal, a state or a local regulation enforcement agency, it’s always the case that none shall be in the enterprise of handling the cars that come into their possession apart from to see that they are auctioned for no matter funds they attract. The federal businesses work with plenty of very massive public sale firms around the nation, as a matter of reality.

With auto sales plummeting, incentives are the required device to drive consumers into showrooms. Regardless of whether the vehicle is owned by a federal, a state or a local regulation enforcement agency, it’s always the case that none shall be in the enterprise of handling the cars that come into their possession apart from to see that they are auctioned for no matter funds they attract. The federal businesses work with plenty of very massive public sale firms around the nation, as a matter of reality.  9Dimen Group has not too long ago added new report “International Automotive Sealing Strip Market 2016 Business Progress, Dimension, Trends, Share, Alternatives and Forecast to 2020” to their research database. Selling a automobile is already a complicated and tedious course of. It becomes even more intimidating if there may be still an current financing on the car you are selling. Thankfully, it is a relatively widespread transaction — people and sellers do it each day.

9Dimen Group has not too long ago added new report “International Automotive Sealing Strip Market 2016 Business Progress, Dimension, Trends, Share, Alternatives and Forecast to 2020” to their research database. Selling a automobile is already a complicated and tedious course of. It becomes even more intimidating if there may be still an current financing on the car you are selling. Thankfully, it is a relatively widespread transaction — people and sellers do it each day.